Columbus, Ohio: Below are the top 10 worst car insurance companies in America. You'll discover why these companies are terrible and then you’ll learn a few tips car insurance companies don’t want you to know. This is because if enough people take advantage of these tips, car insurance companies would lose millions.

Here Are The Top 10 Worst Car Insurance Companies In America (#1 Is The Worst)

- MAPFRE North America Group

- MetLife Auto & Home Group

- Mercury General Group

- Progressive Insurance Group

- Liberty Mutual Insurance Companies

- Nationwide Group

- Allstate

- Farmers Insurance

- Geico

- State Farm

These companies were ranked by Consumer Reports. The ratings are based on survey feedback from over 50,000 Ohio drivers.

There are a number of reasons why these companies scored so poorly, however below are the top 3 complaints all these companies had in common.

- Refusing To Pay Claims

- Poor Customer Service

- Dishonest Billing/Rates Increases

Refusing To Pay Claims

Survey results showed these companies routinely refused to pay claims or stalled payments on claims. They may stall payments for legitimate reasons such as waiting for medical records, police reports, etc. However, they may also stall payments by giving you lengthy and confusing directions to file your claim. This gives them time to investigate your claim for fraud or find reasons to refuse paying you. If you find yourself in this situation, consider hiring a car insurance lawyer.

Poor Customer Service

Drivers were asked why they gave these companies a poor rating in customer service.

Below are the most common reasons:

- Withholding Driver Discount Information

- Uneducated/Rude Agents

- Dishonest Billing

- Long Hold Times

Dishonest Billing/Rate Increases

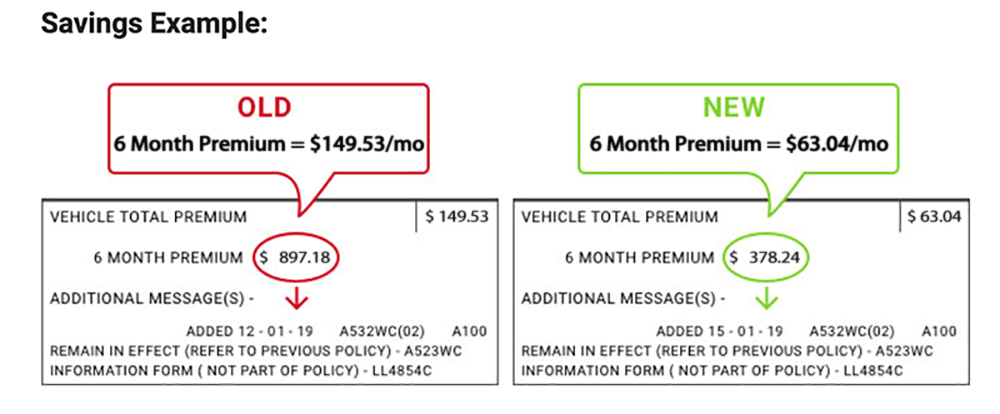

A large percentage of these companies were accused of dishonest billing according to the 2019 survey. A majority of drivers reported being overcharged for car insurance. When the overcharges were disputed, drivers had to go through a long process in order to get it fixed. Here is the problem. Not all customers inspect their monthly bill. Car insurance companies know this. So you may be overpaying for months without knowing it. In addition, some of these companies had the highest average rate increases. A few of these companies raise their rates by as much as 25% every 6 months depending on where you live.

How To Pay Less For Car Insurance

Here is the key to lowering your insurance. Take advantage of every discount you qualify for. There are a few discounts your car insurance company will automatically give you. Discounts for bundling insurance, discounts for paying your entire policy upfront, etc.

However, there are other discounts you must ask for. For example, if you have not had a ticket or if you have not been in an accident in the last 12 months, you automatically qualify for a HUGE discount with most insurance companies.

ConsumerReview.org is the only site we discovered that gives you quotes that include ALL the car insurance discounts you qualify for. However, many drivers have not heard of this site. Our own Amy F. tested this site and was able to lower her monthly payment by 70%.

Has Your Agent Told You About This?

Unfortunately the answer is often “no”. This is because your agent is paid commission which means the more you pay, the more money they can put in their pockets. Below is a list of little known car insurance discounts as well as their average yearly savings:

- No Tickets In 12 Months: $87

- No Accidents In 12 Months: $107

- Low Yearly Mileage: $84

- Homeownership: $52

- Cars Containing Back Up Cameras: $27

- Life Insurance Policy: $34

- Using The Automatic Payment Option: $25

- Short Commutes: $52

- Days Driven Per Week : $32

- Car Ownership: $30

- College Degree or Higher: $30

You will have to call your agent and ask about each discount individually or you can go to ConsumerReview.org and get quotes that automatically include all the discounts you qualify for.

In addition, If you live 50 miles within Ohio, are currently insured and have not had a ticket in 12 months, then you may qualify for additional discounts.

You should at least see what discounts you qualify for. Its free, takes less than 60 seconds and could save you thousands.

I hope all these tips help you save money.

Here’s How You Do It:

Step 1: Tap The Link Below

Step 2: Enter Your Zip Code

TIP: (You are never locked into your current policy. You can cancel at any time and your remaining balance will be refunded)